Comments on the same law. The content of the credit history, the principles of the functioning of the information exchange system, controls.

Surely many of you at least once took a loan, and some such a procedure still have to. The western model of life in debt every year is increasingly rooted in our country, taking the ugly outlines. Apoto extent the extension of lending increases, alas, and the number of incomplete loans, and with this you need to do something ...

East News September 1, 2005 All provisions of laws No. 218-FZ came into force on December 30, 2004. "Painting stories", №110-ФЗ dated 21.07.2005. "Development of changes to the federal law" Painting stories ", as well as No. 219-ФЗ dated December 30, 2004." Development of changes to some legislative acts in connection with the adoption of the federal law "Painting stories" and No. 17-FZ dated March 21, 2005. Amendments to Article 4 of Law No. 219-FZ. The new system has already started to function: a central credit catalog of credit stories (hereinafter referred to as TsKKI), credit bureaus (hereinafter referred to as the Bureau), all lenders are obliged to provide information on their borrowers- individuals and legal entities to one of these bureaus. Let's try to figure out this rather complex system.

So, the objectives of the Law No. 218 are "the creation and definition of conditions for the formation, processing, storage and disclosure of the Bureau of Credit History of Information, which characterizes the timeliness of the borrowers of their obligations under loan agreements (loan), increasing the security of creditors and borrowers due to the overall reduction of credit risks, Enhance the efficiency of credit institutions. " This is recorded in Article 1 of the Law. It is important that under its action falls out both individuals and legal entities. We will focus on citizens of the current and future borrowers.

Prehistory

The demand for consumer lending in our country is growing rapidly. Most people choose the goods in accordance with their capabilities and needs: citizens with a high level of revenue - real estate and cars, with lower household appliances, computers, etc. Loans are provided both in the offices of banks and in stores and shopping centers. To obtain a loan for the purchase of a mobile phone or, for example, a vacuum cleaner sometimes just suggest a passport. We need two different identity cards (for example, internal and foreign passports). Achetoba take loan money for the purchase of an apartment or a car, an income certificate will be required.Of course, all loans in our country are issued at interest. At the same time, the more Bank is confident in the solvency of the borrower, the lower the interest rate turns out. For example, for mortgage loans issued to people with quite high and otherwise confirmed revenues that have passed the procedure for thorough check in the bank, the rate of 14-15% per annum is considered normal. For other consumer loans, no one offers less than 18%. Aesl come to the store without money and with one passport, it is possible to be in a very serious "bole": officially up to 30% per annum plus 0-2% monthly in the form of a variety of commissions and fees, the same total rate sometimes reaches 40% and more.

At first glance, it produces a painful impression. But in the conditions of the unresolved market, the banks are forced to lay the risks of the non-repayment of debts in the interest rate on the loan at the percentage rate on credit. Approcement of overdue debts becomes more and more relevant every day. Machine to banks to cope with it hard, although in many of them there are special structures involved in debt. Attempts to consolidate information have already been undertaken: they say that long before the adoption of the law "Raising stories" existed and still exists a black list of unscrupulous borrowers, foaming their good name with the irregular loans. Now everything should change for the better, and every person will be interested in forming his own positive credit history. She in itself will serve as proof of his solvency (when he comes to a bank for a loan). Avole for all potential borrowers of loan rates, we hope to gradually decline to the level of developed countries (about 4-6% per annum), and the lending market will become more civilized.

Dictionary Terminos

Credit history - Information characterizing the fulfillment by the borrower of the obligations undertakes under loan agreements (loan) and stored in the Bureau of credit stories. Each credit history consists of three parts: title, main and additional (closed).

Loan agreement (loan) - Agreement containing a condition for the provision of commercial and (or) commercial (bank) loan.

Credit report - A document that enters into itself information included in the title and main part of the credit history. The Bureau provides it at the request of the user's credit history and other persons eligible for this information.

Credit history formation source - An organization that is a lender (creditor) under a loan agreement (loan) and representing information included in the credit history in the Bureau.

Subject of credit history - A physical or legal person who is a borrower under a loan agreement (loan) and in respect of which a credit history is formed.

Bureau of credit stories - a legal entity, which is a commercial organization and providing services for the formation, processing and storage of credit stories, as well as to provide loan reports and related services.

User credit history - An individual entrepreneur or legal entity (usually a bank, a credit institution), who received written or in a different way, documented the consent of the subject of credit history for obtaining a loan report to conclude a loan agreement (loan).

Central Catalog of Credit Stories (TsKKI) - Division of the Central Bank of the Russian Federation, the leading database created to search for the Bureau in which the credit history of citizens and organizations are located.

State Register of the Bureau of Credit Stories - Open and publicly available federal information resource (site), containing information about the bureau of credit stories entered into this registry by an authorized state body.

Credit history subject - a combination of digital and letter symbols determined by the credit history entity (borrower) used by them and (or) with its consent by the user of credit history when sending a request for a bureau in the Central Committee on the Bureau in which (which) formed (formed) credit history (credit history) This subject, to confirm the legality of issuing this information.

Operating principle

At the same way, banks will now check how goodbye you extended previous loans: speaking as credit history users, they can request information about you at the Bureau that work, and in the absence of such - in the Central Committee. The latter will answer, in which of the Bureau there are such information (Article 13). Information exchange occurs very quickly, since all organizations involved in this use computer databases and send answers to requests in the form of electronic messages.

Credit history content

What information are in this document stored for seven seals to the Bureau? The most diverse, allowing, firstly, to unambiguously identify the personality, and secondly, to trace the step by step his past as a borrower. Each credit history of a physical or legal person in accordance with Article 4 of the law consists of three parts: titular, primary and optional (closed). The first includes (for citizens): Full name, date and place of birth, passport details, taxpayer identification number (INN) and the individual personal account number specified in the certificate of state pension insurance (if the last two numbers have been indicated).

The sign of a person's credit history is contained by his personal data that did not enter the title part, namely: the address (indication of the place of registration and the actual place of residence) and information about the state registration of an individual as an individual entrepreneur (if it is). And the same information on the obligations of the borrower is for each record of credit history (!), That is, for each loan obtained:

about the amount of obligations at the date of concluding a loan agreement (loan), that is, about the initial amount of debt to the bank;

The term of execution of the obligations of the loan is in full;

percentage period;

changes and (or) additions to the loan agreement (loan), including concerning the fulfillment of obligations;

the date and sum of the actual fulfillment of obligations in full or incomplete amount;

Repayment of a loan (loan) due to the provision, if the borrower did not fulfill its obligations under the contract (for example, in the case of a mortgage loan, the sale of the apartment was pledged);

The facts of consideration by the court of disputes under the loan agreement (loan) and the content of the resolution parts of judicial acts, which have entered into force, except the information that is part of an additional (closed) part of the credit history.

The main part may include other information officially received from government agencies. Inquiry (closed) part of the credit history contains information about the sources of formation and users of credit history, that is, all banks and organizations that have ever provided loans and (or) to a specific borrower subject and (or) requested loan reports to the Bureau. These are the following data: their name, the Unified State Registration Number of the legal entity, the INN, the code of the main classifier of enterprises and organizations (OKPO) and the dates of appeals.

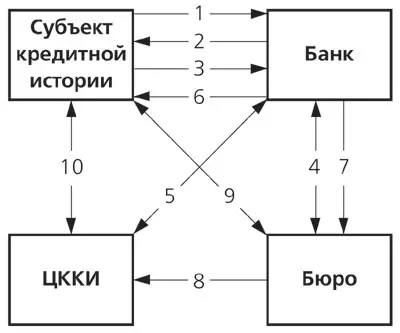

The exchange scheme contained in credit history

2.Bank asks the subject to give written consent to receive a credit report to the credit history bureau.

3.Suberate gives such consent.

4.Bank (as a credit history user) requests a credit report on the subject in the credit bureau of credit stories, with which he has a contract for the provision of information services. Assue Quality, the Bureau provides such a report or responds that the credit history of this subject in its database is missing.

5. Bank turns to the Tskki with a request, which bureau contains the credit history of this subject. Tskki is responsible, and the bank appeals to the specified bureau.

6.Bank issues a loan to the borrower and asks him to consent to the presentation of information about him and the loan received to them in the Bureau.

7.Bank presents this information to at least one of the bureaus of credit stories.

8. All the bureau transfer the title parts of the credit stories of subjects in the Central Committee.

9.All a subject (former, current or future borrower) can request its credit history in the Bureau, and the Bureau is obliged to provide it in full, if it is in its database. If the credit history of the subject in the database of this bureau is absent, it should send a motivated refusal to the subject.

10.All a subject is entitled to request information about what the bureau is its credit history, in the CCQs. ATA The organization is obliged to answer him.

Provision of information

The subject of credit history is a former or future borrower- can request a full information into the bureau about himself and get it once a year for free and as much as a fee (Article 8). He is entitled to challenge the content of his credit history, for which it is necessary to submit a statement of amending and (or) additions to the Bureau. Increased 30days from the date of receipt of the application, the Bureau is obliged to respond: to conduct an additional check of information by requesting it at the source of the formation of a credit history. If the information provided by the subject is confirmed, the Bureau makes changes to the content of the credit history if there is no motivated refusal to the applicant.Of course, you can not know what the bureau is your "case." It is necessary to contact the TsKKI (for free), where information comes from all functioning bureaus. But only the title part of the credit history - and nothing else. Thus, the state represented by the Central Bank division, in fact, does not have any actual data on the good faith or the unscrupulousness of the borrower. Tskki knows only what the bureau is stored your credit history. In this case, you can only welcome in this case, because its leakage becomes impossible ...

VKKKI can also contact any credit organization (credit history user), interested in finding out what bureau is the borrower's credit history. It will receive this information for free (Article 13).

Bureau of credit stories are designed to provide on a contractual basis (that is, for fee) services for the provision of credit reports. This is a document that is received by interested companies and citizens who have addressed to the Bureau. It consists of two parts of the credit history and the main one. Its additional (closed) part is provided only to the Subject "host" of credit history; In addition, the Court (judge) under the initiated criminal case, which is in production, as well as the preliminary investigation authorities in the presence of the consent of the prosecutor.

In accordance with Article 9 of the Bureau's Law, other services related to the development of estimated (scoring) techniques for calculating individual ratings and (or) using their use (based on information contained in credit stories) are also available.

Opinions bankers

How is the law "On credit stories"? What to wait for future borrowers?

Igor Zhigunov, Member of the Board, Head of the Sales Department of the Urban Mortgage Bank: "According to the provisions of the Law, from 1 Iyun 2005. The creation of a credit bureau has begun. To date, there are several of them:" Bureau of credit stories Expried Interfax "and" National Bureau of Credit History " Moscow, as well as the "Joint Credit History Bureau" and the credit bureau with the Association of Economic West Banks in St. Petersburg. The number of created the Bureau law does not regulate. How much they need, practice will show. Perhaps it will be one bureau on the subject of the Russian Federation. However, it is important To understand that its sufficient array should be accumulated to efficiently use information. Ana it will take at least two to three years. As a result, this law should contribute to the future reduction in bank risks when considering applications for credit and decision making, as it will allow systematically to receive information about the previous Debt relations of the potential applicant. "

Alexander Khoshenko, Member of the Board, Head of the Department of Work with the Physical Persons "Raiffeisenbank": "Bureau of credit stories began to work quite recently, therefore it is too early to talk about any results. However, it can be assumed that the procedure for obtaining a loan will be significantly simplified: accelerated the adoption process Decisions on a loan application for the bank, as well as the number of documents submitted by a potential borrower. But in the short term, a miracle will not happen: the time it is necessary that citizens have to accumulate credit history. Thus, the appearance of the Bureau will first and foremost to simplify the life of potential respectable borrowers in the future , So as the information is accumulated in the Bureau database. Worth the actual start of the work of the credit bureau may be an unpleasant surprise for customers, once "forgetting" about their obligations to creditors, as well as those who introduce different misconception banks , received loans for a total amount over all times Smart measure. In many cases, such citizens are unlikely to be able to count not only on credit bank, but also to other services, such as a loan contract with a mobile operator or payment of insurance in installments. September September 2005 Our bank provides information on its borrowers to the following bureaus included in the state register of credit bureaus: "Bureau of credit stories Expried Interfax" and "National Bureau of Credit Stories".

Oleg Dmitrienko, The Deputy Chairman of the Board "Absolut Bank": "Now the Bureau of credit stories are at the initial stage of creation and will actually become in force, in my opinion, in two days, when a sufficient amount of borrowers will be accumulated. Increased bureau databases and accordingly, the effectiveness of their Works depend on how active retail banks will participate in this process. The in the distance of the boron's borrower in the boron database will reduce the bank's costs to analyze its creditworthiness, and it will happen when the bureau will have a fairly large base. But questions to the law " There are still any credit stories. For example, in terms of the fact that in accordance with this law, information about the borrower is provided to the Bureau only with its consent. It turns out that theoretically, information on unscrupulous borrowers in the database can not do at all. In addition, In my opinion, it would be appropriate to create a federal credit bureau of credit stories. "

Security and control

First, in Art. 7 (Part 5) clearly states that the provision of information in accordance with this law is not a violation of official, banking, tax or commercial secrets. Secondly, in accordance with Part 2 of the same article, the bureau of credit stories ensure the protection of information with certified protection means during its processing, storage and transmission. Each bureau should have a license for the technical protection of confidential information (see.17 of the Federal Law No. 128-FZ of 08.08.2001. "Olision of individual activities"). Such licenses issue a federal technical and export control service (FSTEC). Thirdly, the Bureau and their officials are responsible for unlawful disclosure and illegal use of the received information. Law №219-FZ dated December 30, 2004. Changes in the code of administrative offenses: illegal actions to receive and (or) the dissemination of information constituting a credit history if they do not contain a criminal acting act, entail an administrative fine on citizens in the amount of 10 to 25 minimum wages (minimum wages) , on officials, from 25 to 50mother or disqualification for up to three years, on legal entities - from 300 to 500 minutes. For more serious offenses, the criminal code of criminal code is provided.

To control the execution of the Law "On Credit Stories" is intended by an authorized state body. Recompute with the Resolution of the Government of Arf No. 501 of 10.08.2005. "The offral executive body authorized to carry out functions to control and supervise the activities of the Bureau of credit stories" is the Federal Service for Financial Markets (FSFR). It leads the State Register of the Bureau, establishes the requirements for the financial situation of the Bureau's participants, conducts control and auditing activities, interacts with SCKIPR.

Accepting the Law "On Credit Stories", the state is trying to resolve the process of issuing and repaying loans, to encourage each to form its own positive credit history. If after a while, the exchange of information on borrowers will still begin to function in full force, it will contribute to the establishment of a civilized market and simplify the procedure for obtaining a loan. But, unfortunately, none of the specialists indicated the possibility of reducing interest rates on loans in the future, although it would seem, they should fall when banking risks decrease. In general, the system just started working, so we will live, see ...

The editors thanks "Raiffeisenbank", "City Mortgage Bank" and "Absolut Bank" for help in the preparation of material.