Civil liability insurance during redevelopment of residential premises and their operation.

Every minute we feel responsible: for children, older parents, four-legged pets. Worried, no matter how the accident happens. Aesley leave at home brigade workers doing repairs, and you will go crazy at all. It is not enough that the apartment will defeat, so it will also fill others. Applied to the neighbors will have to ... Is it possible to remove some of the problems and protect yourself from unexpected costs? Professionals are responsible for editorial questions.

The fact that at the time of your absence of the house, to gain calm, will not prevent insure his housing and stuff in it, it was said in the article "away, anxiety!". The material was devoted to the problems of property insurance. Today we want to talk about two other types of insurance, closely related to each other and with those described in the previous article. This is the civil liability of owners, tenants and tenants during the operation of residential premises and during their redevelopment (reorganization). Civil liability means responsibility for the harm that you as an insurer can cause life, health or property of third parties called beneficiaries. They can be as physical faces (house neighbors, guests of neighbors, random passers-by and other people) and legal (commercial firm, store located on the first floor or in the basement under your apartment or nearby). Insurance of civil liability allows you to shift on the shoulders of the insurance company a compensation of damage that you are unintentional (!) We inflicted these people or companies. By analogy with the OSAGO (mandatory insurance of autocarted responsibility), pay the neighbors whose apartment flooded with water from your faulty crane (read "for a car that suffered as a result of an accident committed by your fault"), you are not you, and your insurer.

Now both mentioned types of liability insurance are not mandatory. But in August, at a meeting with journalists, the Director of the Construction and Housing Department of the Ministry of Industry and Communist Party of the Ministry of Industry RF Sergey Kruglik said that the authorities do not exclude the possibility of introducing a system of compulsory civil liability in Russia owners of housing. Of course, before that, long-term experts believe that it is first necessary to establish the mechanisms of CTP, after which it will be possible for housing.

The astraching of civil liability in carrying out a reorganization (redevelopment) of residential premises, on the contrary, has already become almost mandatory for those residents of the capital, who decided to seriously deal with the change in their apartment. To go to the Moscow Interdepartmental Commission for resolving redevelopment is meaningless if you do not have the appropriate insurance policy. Neither you yourself nor a firm that assist in the design of the necessary documents will not be able to expect the favor of officials. Alternative purchase of the policy, allowing you to get "good" to redevelopment - collecting written agreements on your repair with countless inhabitants of the apartment building, seems to be both very long and difficult to be projected. According to the law of Moscow No. 22 of April 7, 2004. Only two documents are visible: written consent to the owners of a residential building or civil liability insurance contract.

Liability insurance for housing

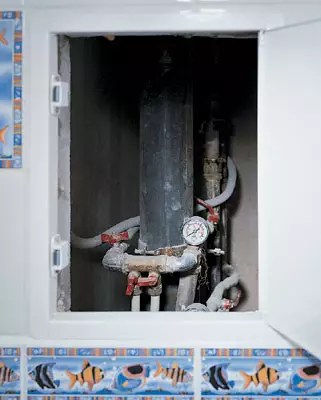

The accidents of water supply systems, heating and sewage, closure in the electrical wiring and explosions of household gas occur in homes and apartments with frightening regularity. Furious people like these cases lead relatively rarely, but the property suffers almost always. Appreciate yourself this situation: while there was no one at home, your apartment completely burned out and you remained at the broken trough. And from the fire, not only your family, but also the tenants of other apartments were injured: the fire rose up and touched on several floors, and the valiant firefighters overreach and flooded with water and foam and your own, and other people's walls, floor, furniture, household appliances and equipment. Who will pay the neighbors? You (not hob, DEZ and other organizations)! Or an insurance company if you have purchased a responsibility insurance policy in advance during housing operation.Avot is less terrifying, but a more typical case. Employees of the insurance company "Consent" are told: "Because of the leakage in the heating pipes from our insured, which bought a civil liability insurance policy during the operation of housing, there was a bay of an apartment located below. Our company paid the affected neighbors of $ 1830."

Is it possible to insure civil liability in the operation of housing? Will there be a purchase of an empty money?

Dmitry Maslov, Head of the Rosgosstrakh property insurance center, Vice-President: "Insurance policy is a guarantee that with unforeseen damage to your and someone's property you will not be alone with a problem, and all expenses will reimburse the insurance company. In the case - Compensates for the damage to the neighbors victims of your fault. Can this be called a waste of money? This money paid for your peace of mind, if the insured event did not come, or in order for the insurance event on the occurrence of the insurance event, you need to understand. that when insuring apartments, the most frequent situations are damaged by water, when damage is subjected to both the customer property and the property of the neighbors below. The probability of claims in this situation is very high, and it is insurance of civil liability to cover losses. So this type of insurance can be Name one of the most sought-after apartment insurance market. "

Elena Fokina, Head of Property Insurance Department of Individuals Insurance Society "Standard-Reserve": "In the course of exploitation of housing at any time, unforeseen circumstances may arise, as a result of which the neighbors may be damaged. Ion will be completely reasonable to demand compensation for damages. Not excluded, What will arise a conflict situation, which can reach the trial. Here is an example from real life. Our client insured civil liability during the operation of an apartment for $ 10,000, paying for insurance $ 100. Insured in his absence occurred: broke the pipe in the kitchen, and suffered Finish not only in the apartment of the insured, but also in two floors below. We paid $ 8,000 neighbors. How do you not think about it, take the responsibility to third parties on yourself or shifting it to the insurance company! In addition, our insurance society will not only compensate the expenses of the victim , but, if necessary present the interests of the insured in court. "

Is insurance of civil liability in the operation of housing in an independent type of insurance? How are the two types of property insurance and civil liability related?

Dmitry Maslov: "The civil liability of the client may be insured both separately and in a complex with property. At the same time, comprehensive insurance reduces the cost of the policy and gives a more complete protection of the client's property. Imagine this situation: the pipe and the apartment is broken in the apartment of our client Water damaged not only his home property and finishing a newly renovated apartment, but also penetrated down, heavily flooded two apartments at once and causes significant damage to their property. The total amount of damage exceeded 600,000 rubles. Of these, more than half of them are paid to the neighbors in civil liability insurance policy, The rest is the client on the property insurance policy. "

Elena Fokina: "The civil liability of the tenant is an independent object of insurance. It can be insured both in a separate policy and in a complex with an apartment (structural elements, finish or driven property) - in this case, every type of insurance will cost the client cheaper."

Wessently, are the features and advantages of insurance products offered by your company to individual housing owners and tenants?

Dmitry Maslov: "Rosgosstrakh company offers customers as simple insurance products (from the" Express "line) and comprehensive programs. For example, buying a policy" RGS-express apartment ", you can choose what to insure in your home, From what unforeseen situations to protect him and how much to pay for all this. Moreover, the policy is drawn up in a few minutes - without a written application of the Client, without inspecting the insurance facility, without the preparation of interior decoration and domestic property. There are more complex products- an individual approach to each client Allows you to choose optimal insurance protection. "

Elena Fokina: "The insured is always given the possibility of choosing from several options, depending on the size of the insurance sums." Standard-reserve "offers two different form of contracts:" Classic "and" Express Policy ". Classic insurance option takes into account all habits And the wishes of the client, and the "fast" policy helps to save his time and means. By contacting our company, you get the opportunity to insure property with inspection and without inspection for a period from one-month to the year from the actual insurance risks to you, discuss the changes in the terms of the contract for you The insurance period (an increase in the sum insured, changing the territory and terms of IT insurance, to make payment by installments, conclude an integrated property insurance contract and responsibility. "

What risks are the most "popular"? Of course, fire and water (this is how insurers say). Insurance can also be carried out at a complete risk package: In addition to the two listed, mechanical damage, unlawful actions of third parties and some other, more specific, such as terrorism are usually added here. (About all this in relation to property insurance Our magazine told in detail in the previous article on this topic.) The greater the number of insured risks, the naturally, above the cost of the policy.

Reliefing companies (meaning "Rosno", "Spasskit Gates", "Standard-reserve", "Max", "AlfaStrakhovanie", "Consent" and many others) Insurance of responsibility during the operation of residential premises is as a separate program. However, the responsibility is most often not insured separately. On responses of specialists, in 80-90% of cases, real estate is simultaneously insured (sometimes a movable property located inside) and responsibility during its operation.

The size of the insurance premium, that is, the cost of the policy depends on the amount of the sum insured and amounts to different companies from 0.7 to 1% of it. Thus, in order to insure their responsibility to third parties by $ 10,000, you need to pay $ 70-100 for a policy of one year. The policy of $ 20,000 with the same period of action will cost you $ 140-200 IT.D.

What civil liability insurance programs offers your company?

Denis Zenka, head of the project of the company's liability insurance center: "Our company offers three civil liability insurance programs. The basic product "Civil responsibility of the tenant" allows the client to avoid possible losses as a result of harm to third parties in the maintenance and operation of the apartment, as well as during the work on finishing, repair or reorganization in it. Liability insurance makes it possible, after paying insignificant compared with the size of possible damage to the amount, shifting all the costs of the insurance company.

In addition, we offer a combined insurance product "Megapolis". This framework can be insure both the risk of civil liability and property (design elements, finishing, engineering equipment, movable property) and domestic animals. Finally, we have an insurance product, which is a novelty for the Russian market, although its analogues are very popular in the West. It is called "confidence" and provides for the coverage of all risks associated with civil liability: the responsibility of owners of residential or non-residential premises (apartment, cottage, garage), pet owners and firearms, responsibility for children under 14 years of age plus other risks. The program acts around the world, with the exception of zones of armed conflict. Becoming it with a participant, you will feel protected from unforeseen circumstances, even if you are outside our country. Such policies are called "umbrella", as they represent a kind of umbrellas that protect policycriefs from all possible risks. "

What risks do you think most often?

Denis Zenka: "The most common risks that are indicated in the absolute majority of insurance policies - causing harm to third parties (neighbors) as a result of bays and fires. Ito is quite explained. Fires, although it rarely happens, but they make the health and property of people maximum harm, So, insurers are trying to insure them. The bays that arose due to damage or improper installation of heating and water supply systems, according to our statistics, are particularly often occurring events. The company's own company up to 90% of insurance claims (, of course, is about insurance of property and civilian Responsibility), for which reimbursement was paid, resulting from water action. "

Responsibility when carrying out redevelopments

So, you have conceived repairs with redevelopment of the apartment. The goal of such global transformations is always the desire to live better, more comfortable, more comfortable, modern, more beautiful, finally. Getting on the path of serious changes in your home, you can start glazing the balcony, replacing window blocks, transferring or replacing plumbing, heating, heating or gas appliances and equipment, re-equipment of bathrooms and toilets, transferring or disassembling partitions, redevelopment of rooms with change or without Changes in the system of engineering communications, combining several apartments, mastering the attic space above the part of the residential rooms for the purpose of the device for additional housing or attic, as well as other types of reorganization that do not belong to the category of prohibited law. However, each type of transformations need "good" municipal officials. And to obtain a resolution of redevelopment, you need to insure your civil liability when carrying out work on reorganization.

In essence, the insurance of civil liability when redeveloping apartments is a private case of liability insurance during the operation of residential premises. But the first type of insurance should be recognized as more complex and more expensive than the second. And that's why. The "complexity" of insurance of liability in repair is not available not two, but three subjects of insurance: an insured person is added to the owner of the apartment and the insurer-insurance company, that is, a construction company conducting work on the insurance site (in the apartment of the insured). This organization must have a license to implement relevant activities. Under the conditions of the contract concluded in such cases, during his term of its action, you can change the insured person as an insurer, that is, to abandon the services of one company and hire another. Higher (poisoning with liability insurance) The cost of the account insurance policy is due to the fact that in the process of construction and repair work, the likelihood of an insured event is increasing.

About insured, insurers and insured persons

Zinaida Vyskov, Chief Expert of the Department of Methodology and Underwriting by the Responsibility of the Alfactory Group: "In order to obtain permission from the district housing commission on redevelopment of residential premises, the owner of the apartment will have to fulfill a number of rather harsh requirements. One of them is the written consent of the neighbors for redevelopment, Moreover, it is required not only from the owners of neighboring apartments, but also from people living in other entrances. Often the process of registration of such documents is so long and time consuming, which is much easier to acquire a policy of insurance of liability to third parties when reorganizing residential premises - in this case consent The neighbors will not need you.Assistance with the contract concluded in such cases, the investigator is the owner of the apartment, and the insured person- construction organization, carrying out work on reorganization and redevelopment. In this case, the obligatory condition of the contract is the existence of a construction license (after all, repair with redevelopment is much more serious than the repair cosmetic). If you hire a firm that does not have such a license, the likelihood that the repair will be performed poorly, as well as the likelihood of harm to third parties will increase significantly. Therefore, in order to redecessing the apartment implemented a respected construction organization, you are interested in both the future insured, and the insurance company. A small (compared to the general cost of repair) savings of funds at first can turn into a huge loss at the end.

According to the field of civil liability insurance during redevelopment (reorganization) of residential premises, losses caused to third parties are covered, that is, by your neighbors, due to the shortcomings of the construction work. For example, if an apartment bay occurred below, due to poorly performed plumbing works (let's say, leaks at the junction of the sewer pipe and a flexible eyeliner to it), the insurance company recognizes this by an insured event and compensates for the damage caused. Alfactor also provides its customers with the opportunity to fix the extended insurance period. This means that the company will take into consideration insurance cases that occurred both during the period of the contract, and during the whole year after its end, if the reason for the insurance event was all the same construction work performed during the insurance period. "

Why exactly now have become so relevant issues of civil liability insurance during redevelopment in apartments?

Sergei Nikitin, Head of the Responsibility Insurance Department of the Space Gate Group: "There are several reasons here. First of all, the average area of apartments has increased, and with an increase in free space, ideas arise and on interior design, and over-planning. This is a subjective factor indicating that What people began to live better. The number and scale of redevelopment increased. Virtually any construction, finishing materials and interior solutions have become available. And finally, there are powerful tools that today allow everyone to do in their apartment almost everything that comes to mind. Now, having "Bulgarian", discs with diamond spraying and perforator, you can destroy anything. In the number of the nearest concrete wall. The apack all this is done not in the individual cottage, but in an apartment building, the consequences of such "creativity" are easy to predict. . Moscow number 37 of September 29, 1999. "On the procedure for reorganization of premises in residential buildings on The territory of the city of Moscow "and the changes and additions to it, adopted on April 7, 2004, are directed just to limit this amateurness. Civil liability insurance provides financial guarantees affected by the case if damages still fail to avoid. "

Viktor Belikov, a leading specialist of the Department of Property Insurance of the Max Company: "Talking that it was now that this problem has become relevant, lately, over a few years ago, redevelopment of apartments and offices got widespread in Moscow and the region. Syntoray in the capital. Civil liability to third parties in carrying out premises is a mandatory procedure. Lidlice the lack of this document you simply will not be able to get an official permission to change your home or office. Thus, before you begin redevelopment, the apartment owner will have to not only coordinate the project in architecturally - Expandment management, sanitary and epidemiological service and Mrs.. He will still need to obtain the consent of the "people who occupy the adjacent premises", that is, the neighbors. This is drawn up by a special act agreement. It should be made to compensate for the possible damage that the insurance guarantees The company, where the apartment who wishes to do the apartment is obliged to insure their civil liability to third parties during construction work. To conclude an insurance contract, a copy of the project to redecessing the premises and the passport details of the owner of the housing is necessary.

Instructing its responsibility to third parties when redeveloped (reorganization) of premises, the insured minimizes possible conflict situations both with citizens and authorities, may better control the quality of construction work, including after their completion, and also provides maximum Protection of your property interests. "

How can innovations in the Moscow law be affected in the situation with the reorganization of apartments in other cities and regions of Russia?

Sergey Nikitin: "Other subjects of the Russian Federation it would be advisable to adopt the experience of Moscow. Control over the reorganization in residential buildings is necessary, since unauthorized and uncontrolled work may affect the rights and interests of other tenants. But, on the other hand, the regional administration and regions themselves determine the priority tasks for themselves. Therefore, it is difficult to assume anything, much will depend on how successful the experience of the capital will be. "

Victor Belikov: "As we have accepted, most initiatives are first accepted in the center, and only then applies to the outskirts. If the experience of the capital is successful, I think he will soon receive a continuation in the regions. Forward, this is, of course, will Cap of large cities, such as St. Petersburg, Novosibirsk, Rostov-on-Don, Kazan, Krasnodar IT.. "

Is it possible to insure separately your civil liability when redevelopment in the apartment? What type of policies (constructive + responsibility, finishing + responsibility or other combinations) uses the greatest demand in your company?

Sergey Nikitin: "Insurance Group" SPASSK GROTH "from 1999. Insuring the risks of civil liability associated with redevelopment of residential premises. Also, our company insures similar risks when redeveloping non-residential premises in residential buildings. Unas has different formalized products:" My cottage " , My car, "My health" of IDR. The "My Apartment" policy, combining the combination insurance of residential premises with civil liability in the case of harm to third parties, uses good demand. This policy has a low cost and allows you to conclude an insurance contract. In a matter of minutes. But any standardized product with fixed parameters is still inferior to the policy, the terms of which are determined individually. Therefore, many of our customers continue to insure, making two policys: separately for insurance for finishes and property and separately for civil liability. The most attracted individual The minds always give preference to separate insurance. "

Victor Belikov: "When carrying out redevelopment, you can insure not only your responsibility, but also construction risks. Avposlyance, when the housing repairs will be completed, it makes sense to acquire an interior finish insurance policy. Special Democratic Property Insurance Programs have been developed. For example In the Interior program, the object of insurance becomes household property. At the same time, not only interior items are insured, but also the elements of the premises finishes. That is, when an insured event, the company will reimburse the client and the cost of lost property, and the cost of repair. To obtain the policy is not required. Inspection of the object. KSLOV, in our company for each subsequent insurance contract you get a discount of 5% of the insurance premium (contribution).

On the similarity and difference of two types of liability insurance

Anna Norkequiche, Head of the Control Department of the Company's Responsibility: "Assigner's civil liability insurance - a completely independent service. You can insure only your property, or only civil liability, or combine both types. As for repaired apartments in which reorganization or redevelopment is carried out. , the insurance of civil liability of the tenant property of such a premises is practically no different from the traditional liability insurance during the operation of housing. The only difference is the tariff for which the insurance premium (fee) will be calculated. The fact is that at the time of repair will be applied to the raising coefficient, since Construction work increases the likelihood of an insured event. Every repair is associated with increased danger - its length of mechanical damage, fire, the accident of the heating system and other troubles are completely possible. Often there are cases when immediately after the end of the work breaks the valves on new batteries, suddenly begins to flow just the installed tank, although you bought all certified and reliable. It is for this reason that in our company the service life does not depend on the repair period, your policy will be valid for at least within a year.

Of course, like any insurance product, the insurance of civil liability of the tenant has its own specifics. There is no inspection of the premises, as in the insuring property, in this case it is not required. Avota Inspection of the neighbors's apartments would be desirable, although according to the law it is impossible (actually, this is the specifics of this type of insurance). The impracticity of verification of the state of neighboring apartments increases the likelihood of fraud and fraud. Suppose you insured the apartment on September 1 and told about this neighbors from the bottom. Then you started to make repairs, and on September 20, you have just threw the valves on the batteries, which neighbors immediately recognized. The next day, they reported in indignation that because of you they fell off the wallpaper, there were divorces on the IT ceiling appeared, although in fact their apartment came into disrepair much earlier. Confirm or refute the fact of damage to neighbors and determine the true size of the loss is very difficult, but maybe. The insurance company will be engaged in this, and it is she protects your interests in court. "

How much is the policy of insurance of civil liability during redevelopment (reorganization) of the apartment? What does its price depend on?

Zinaida Vyskov: "The cost is determined by the amount of the sum insured (the company's responsibility limit). The most common amounts on such agreements are $ 10,000, $ 20,000 and $ 50,000. The cost of the policy with the company's liability limit of $ 10,000 is $ 100-150 and depends on the repair period With redevelopment, list and volume of the construction work performed.. "

Victor Belikov: "In our company, tariffs are calculated individually, in accordance with the wishes of the policyholder and, depending on the availability and degree of influence of insurance risks. Basic tariff rates for civil liability insurance for causing damage to third parties during or reorganization of premises are (in percent from the sum insured): physical damage to 0.84%, property damage is 1.02%, physical and property damage - 1.5%. In other words, insuring their civil liability for $ 10,000, you, depending on the type of damage, Pay for the policy from $ 84 to $ 150. "

Elena Fokina: "In case of civil liability insurance in the amount of $ 10,000 at the time of holding an insurance premium in the apartment (that is, the cost of the policy will be $ 100-300, depending on the type and method of carrying out repair work, the floors of the room, the presence or absence of a contract with the licensed construction organization, work period and a number of other factors. Avot in the case of civil liability insurance during the operation of an apartment for the same amount of $ 10,000 Insurance award will be $ 50-100, depending on the material overlap in the house, the availability of permission to redevelopment carried out in the dwelling From who she was produced (by experts or individuals), floor, renting apartments, the period of insurance IT.D. Each type of insurance will cost another 30-50% cheaper if civil liability will be insured in a complex with an apartment (constructive + Finishing) or driven property. "

Let's hope that the insured event will never happen to you. If he passes during the action period, the insurance company will have to pay insurance compensation within 3-20 days after receiving all the necessary documents on the insurance case or after entering into force the court decision. We will tell Ouridic aspects in one of the following log numbers.

The editors thanks Rosgosstrakh, AlfaStrakhovanie, "Standard-Reserve", "Spasskit Gate", "Rosno", "Consent", "Max" for help in the preparation of material.